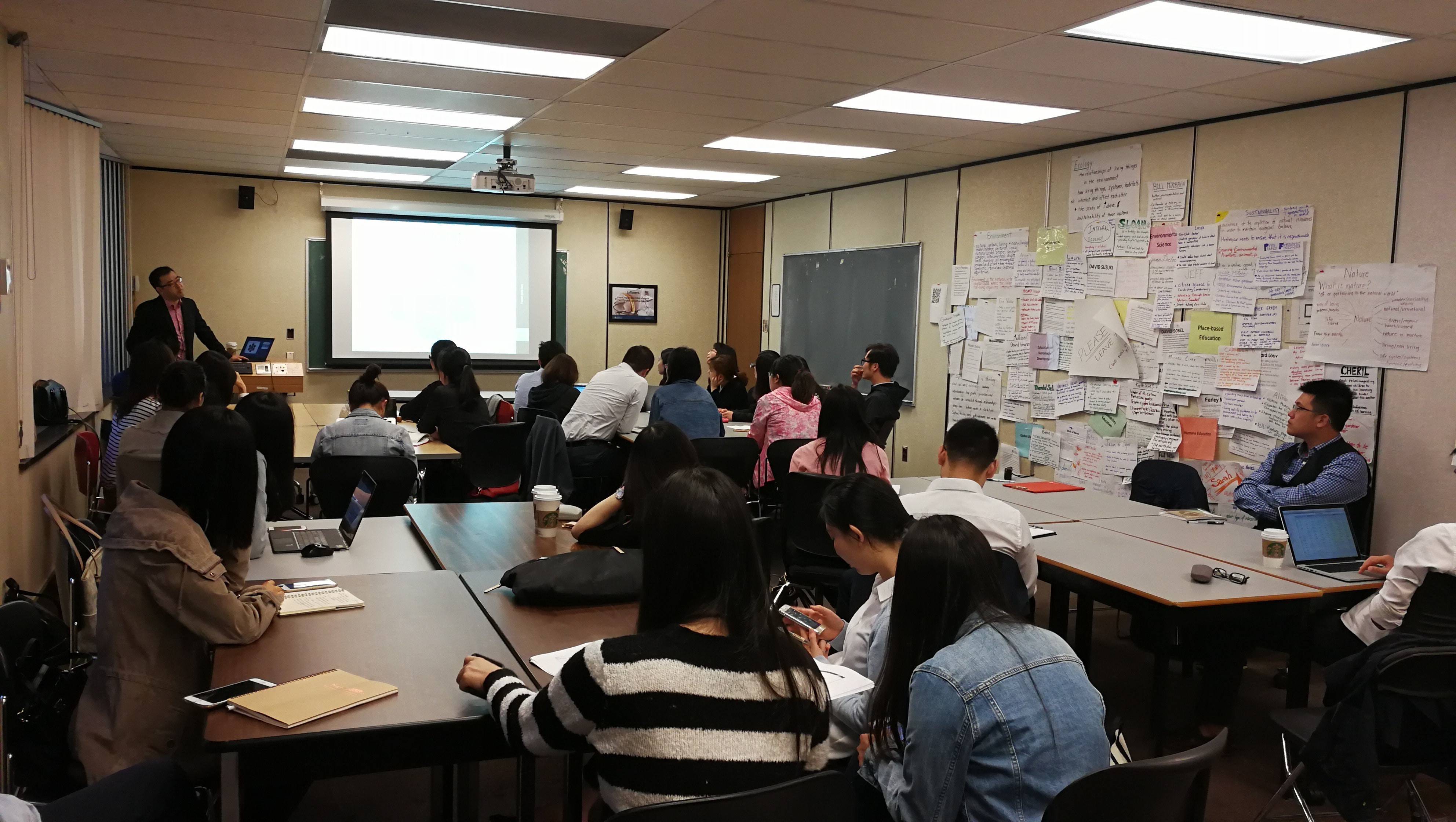

On July 13, 2017, the first session of NHC Fund Accounting class was held in University of Toronto. The presentation was distributed by Shawn Luo, who is an expert in Fund Valuation with more than 3 years working experience in SGGG Fund Services Inc.

Our students are from different background, but are willing to learn more about fund accounting. The presentation was in a communication friendly environment, that students were encouraged to come up with questions during the presentation for everyone to discuss, and our speaker shared his opinions after.

The presentation covered three parts, started from the Investment Fund overview, followed by Fund Accounting discussions with accounting learning points recapture, and ended by differentiating relevant designations.

To begin with, Shawn gave us an introduction on Investment Fund, and discussed multiple fund service providers as well as the regulators. Shawn explained to us that Fund investment helped investors to share resources together to buy larger securities. By taking advantage of Investment Fund, a purchase of one share can stand for an investment of more than 400 securities. The key take away from the first section is that there is no perfect portfolio for every investor, so each bank provides over 500 portfolios for clients to choose from. Not only fund services providers like portfolio managers, but regulators are the key stakeholders in the fund market, and they ensure that the market can run under designed regulations.

On the second half of the course, Shawn briefly mentioned three big equations in accounting for students who are not in accounting background. Then, an introduction on Fund Accounting was distributed by explaining six fundamental elements including capital stock, assets, liabilities, expenses, incomes, and investments, which gives students an insight on fund operation in accounting perspective.

In the end, our speaker summarized the relevant designations including CFA, CPA, and CAIA. For students who are interested in fund accountant position, they have a better understanding of which designation is suitable for them.

To summarize, the first Fund Accounting session gives the audience a broader and deeper understanding of the fund market, and insights of fund accountant position. Our next session will take place on Thursday, July 20, 2017. The agenda includes sample fund NAV package discussion, sample financial statement analysis, and current industry trends review. NHC will continue providing a valuable learning platform for all participates.